2023

QuickBooks Live Bookkeeping Pricing

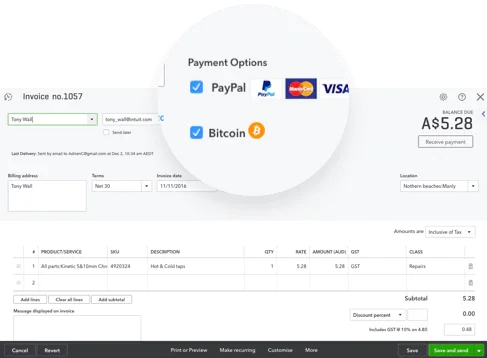

Each receipt represents money that has already been spent, and the bookkeeper is tasked with bringing the books up to date, categorizing each expense and attributing it to the right department. Invoice automation platforms also integrate with popular accounting software like Intuit’s QuickBooks Online and more, so bookkeepers only need to enter invoice information in one place. Traditionally, at least for small businesses, that often meant driving to a local bookkeeper’s office with a box of invoices and receipts at the end of each month. The bookkeeper would sort through them and enter that information into spreadsheets or bookkeeping software. For pricing, we considered whether a service offers a free trial or a free version of its software as well as the affordability of its lowest and highest price tiers. Pilot users said that they appreciate the peace of mind that comes from knowing that their books are being handled accurately and in a timely manner.

Beyond those big ones, virtual bookkeepers provide the same benefits as on-site bookkeepers in that they help organize income sources, track the flow of money, update payments, and more. The way a virtual bookkeeper works with their clients is by giving them online access to their financial accounts, documents, and server, in some instances. The bookkeeper logs into their clients’ accounts from wherever they are, and then works online.

And starting has never been easier with the Brilliant Bookkeeper course. This start-to-finish course is designed for beginners in mind, and will give you the confidence and skills required to launch your virtual bookkeeping business. It’s also ideal for brand-new businesses because FinancePal can help with entity formation. Merritt Bookkeeping scored the highest of our online bookkeeping providers in the pricing category—at an affordable $190 per month, it is a transparent and fixed rate. Being a Merritt Bookkeeping customer also eliminates the need to pay a subscription fee for accounting software, as Merritt will handle everything for you. Bookkeeper.com has four subscription levels, which are determined by the number of transactions per month and the frequency of service.

Accounting Automation

Someone had to be there to run the report, save it in the right format and send it out. In this age of cloud accounting and virtual bookkeeping services, they should be able to have reports sent to you on a schedule. To enable virtual bookkeeping, the business grants the bookkeeper remote access to its server, software and financial documents. The bookkeeper signs onto the company’s secure network from his home or office computer and retrieve documents just as he would if logged onto an on-site company computer. Bookkeepers around the world might also use cloud-based accounting software such as Quickbooks Online or access a hosted virtual desktop, according to Bookkeepers.com. Reconciled offers top-notch virtual bookkeeping services to entrepreneurs and business owners across the United States who do not get time to handle this important aspect of the business.

Moreover, an optimized mobile site helps you get found on Google, plus, triggers 73% of mobile devices trigger additional action, according to research. Plus, G Suite gives you 30GB Cloud Storage, shared calendars, and access to G Docs, Sheets, Slides, and other office tools. There’s a small learning curve for WordPress, but once you get the hang of it, you can turn your business site into anything you want. As a potential client goes through your site, they should find it easy to contact you by email or phone. Regardless, it’s a good idea to invest in a bigger screen to reduce eye fatigue. Slamming away on an 11 or 13-inch screen all day can tire your eyes out quickly.

Whether your bookkeeper fills a full- or part-time position, just having an expert on hand can do wonders for your finances. Now that you know why bookkeeping is so important, the next step is to start bookkeeping for your business. Here are some ideas to get you the help you need to set up your bookkeeping system. The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey. Typical cleanup is complete within 30 days after receiving all necessary documentation.

Have a bookkeeper categorize expenses, reconcile accounts, and close your books with guaranteed accuracy, so you know where your business stands. Our specialized team of accounting professionals will help you understand the benefits of incorporation a business. Our team of professionals can take care of your small business taxes. Their team consists of highly professional and skilled accountants who deliver consistent and top-quality results for your business. Having said that, let’s take a look at some of the top virtual bookkeeping firms serving businesses in the US. Their professional team of experts can easily handle the different complexities of bookkeeping, ranging from daily bookkeeping to offering essential advice.

What is an accountant?

In this guide, we’ll be covering everything you need to know about starting an online bookkeeping services company and more. Starting a virtual bookkeeping business is an excellent idea if you’re looking for a flexible and scalable side hustle or online business. When you have a Small Business Plus plan or higher, you get unlimited online support. All plans come with onboarding, a dedicated bookkeeper and account manager, reconciliation at month-end, balance sheet, P&L, statement of cash flows and a portal with document storage. Higher-tiered plans unlock more transactions and a more frequent service level. The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

If you use accrual-basis accounting, you’ll need the Growth plan, which starts at $990 a month. And the Executive plan, which is built for larger companies that need CFO services, has custom pricing. You’ll need to get in touch with an inDinero rep for a price estimate. However, Merritt can still recommend a solid payroll provider or tax consultant who meets your needs. Every virtual bookkeeping service should have an option that includes this. It might (and it should) cost more than their basic level, but the option should be there.

Accurate Books Guarantee is only available for active customers of QuickBooks Live Monthly Bookkeeping who have provided their current business tax return. If your Live Bookkeeper makes an error that requires you to re-open your books for any month, we’ll correct the error in your books for the month that the error occurred at no additional charge. We provide timely financial and cash flow forecasting services to small businesses using historic and real-time data combined with superior expertise. Choose Analytix Accounting to adopt the modern accounting and bookkeeping processes for improving the financial health of your business. The firm focuses on using proprietary technology and systems that will accelerate project delivery to your clients.

- Bookkeeping is quickly changing with new cloud technology and being able to work remote with clients.

- Virtual bookkeepers work online and remotely for their clients, and this is a distinguishing feature.

- Your bookkeeper takes the lead on your bookkeeping and runs essential reports so you can focus on your business.

- They ensure that you achieve tactical decision-making and break free from redundant bookkeeping tasks.

These criteria were disregarded for providers where no reviews were found. Our bookkeepers average 10 years of experience working with small businesses across a wide array of industries.2 They’re certified QuickBooks ProAdvisors, and many are CPAs. Receive personalized insights including your profit and loss report and balance sheet. This helps inform your business decisions and gives you time to do what you do best. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

QuickBooks Live Bookkeeping is an online bookkeeping service that connects small businesses with trusted, QuickBooks-certified virtual bookkeepers. Your bookkeeper takes the lead on your bookkeeping and runs essential reports so you can focus on your business. Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services. As an insider in the cloud accounting world, I can tell you that many virtual bookkeeping services don’t follow the best practices that have been listed above. If you don’t walk away from your initial interactions with your prospective virtual bookkeeping service feeling 100% confident that this company has your back, then just say no.

Bookkeeping improves business decisions

Virtual bookkeepers have to embrace it to give your business the edge on your competition. To help you stay up to date on all things virtual bookkeeping and accounting, we’ve compiled a shortlist of resources to help you stay up to date with what’s going on in the industry. You can find information about international and national associations, publications, blogs and more. When you promote testimonials, you show potential clients your services can make an impact on their company too. It helps you close the deal faster because they can see the positive results you’ve produced for other businesses.

- “Virtual bookkeeping” refers to online bookkeeping services that perform these tasks remotely.

- Your first month of service with QuickBooks Live is dedicated to onboarding and cleaning up your books at a cost of $500.

- Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content.

- Those include profit-and-loss statements, balance sheets, and anything else a business owner might need to do their taxes.

- Your online bookkeeper will get to know your business and industry, and customize your setup accordingly.

With these five apps alone I can manage every aspect of my clients’ needs. It can be difficult to trust a virtual service with your books, and even harder to know which service to choose. To help ease the process, I’ll show you how I run my virtual bookkeeping service and explain what to look for in these services, so you can make the best decision possible.

CPAs have accounting degrees and must pass the Uniform Certified Public Accountant Examination. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Its biggest drawback is complaints about its lack of communication and follow-through. Customers also cited a long wait time before actually receiving a response when tax-related questions came up. You can always connect with a bookkeeper via message or video chat for personalized help.

Trusted by 1000’s of American Businesses

QuickBooks Live is an online bookkeeping service that’s offered directly by QuickBooks Online, which we ranked as the best small business accounting software. QuickBooks Live excels at helping QuickBooks users with the fundamentals of managing bank feeds, classifying transactions, reconciling accounts, and printing financial statements. Today, virtual bookkeepers are more strategic about using cloud-based accounting software to let stakeholders (the small business owners) see data on mobile and from any location. Larger businesses may also hire virtual bookkeepers, but they’re more likely to have their own internal department for accounting services. Every entrepreneur knows that their most stretched resource is the number of hours in a day. Keeping the books up to date is one of the easiest business tasks to delegate effectively.

Once you know who your audience is, you can start on the channel they spend the most time on. For example, if you offer family or individual accounting, Facebook may be your best channel. If you only work with small business owners, LinkedIn may be a better fit. To figure out how you’ll make money as a virtual bookkeeper, you’ll need to write a business plan. As any good bookkeeper knows, one of your primary jobs is making sure your clients’ financial data is safe and secure. That means communicating with them about who should have access to information and how you prioritize security.

Not all bookkeepers can prepare taxes, for example, which requires an IRS Preparer Tax Identification Number (PTIN), and many tax filing professionals have only limited rights. Loan Note Payable borrow, accrued interest, and repay Also, while any CPA can be a bookkeeper, there are far more bookkeepers than there are CPAs. In fact, many bookkeepers are trained in bookkeeping right after high school.

Virtual bookkeeping, also known as cloud accounting, is when a bookkeeper or accountant works with their client remotely. This is made possible through accounting software that allows you and your bookkeeper to share an account. In this arrangement, the accountant and business must utilize the same accounting software to ensure the proper transfer and communication of files.

No Comments